Your cart is currently empty!

What is CRM Customer Relationship Management?

Say you purchased a piece of equipment (fixed asset) of $5,000 for your business. Balancing the books is the process of closing your accounts at the end of an accounting period (typically a year, but it could be a month or a quarter) to determine the profit or loss made during that period. Because the double-entry system is more complete and transparent, anyone considering giving your business money will be a lot more likely to do so if you use this system. Public companies must use the double-entry bookkeeping system and follow any rules and methods outlined by GAAP or IFRS (the differences between the two standards are outlined in this article). Get instant access to video lessons taught by experienced investment bankers.

Here’s how a CRM system can help your business today

This is a partial check that each and every transaction has been correctly recorded. The transaction is recorded as a “debit entry” (Dr) in one account, and a “credit entry” (Cr) in a second account. The debit entry will be recorded on the debit side (left-hand side) of a general ledger account, and the credit entry will be recorded on the credit side (right-hand side) of a general ledger account. If the total of the entries on the debit side of one account is greater than the total on the credit side of the same nominal account, that account is said to have a debit balance. Double-entry transactions, called “journal entries,” are posted in two columns, with debit entries on the left and credit entries on the right, and the total of all debit and credit entries must balance. Every modern accounting system is built on the double entry bookkeeping concept because every business transaction affects at least two different accounts.

How do debits and credits work with double-entry accounting?

His first book on accounting was “Summa de Arithmetica, Geometria, Proportianet Proportionalita”. Recognizing the significance of accounting, the most modern and groundbreaking theory was discovered in 1494 AD in Venice, Italy by the famous mathematical clergyman https://www.business-accounting.net/sundry-income-definition/ and philosopher Luka Pacioli. But as you can tell, the left side of the formula is intertwined with the right side. (Some corporations have preferred stock in addition to their common stock.) Shares of common stock provide evidence of ownership in a corporation.

Double-entry in accounting software

In keeping with double entry, two (or more) accounts need to be involved. Because the first account (Cash) was debited, the second account needs to be credited. Common stock is part of stockholders’ equity, which is on the right side of the accounting equation. As a result, it should have a credit balance, and to increase its balance the account needs to be credited. This is always the case except for when a business transaction only affects one side of the accounting equation.

For example, consider the entries resulting from an approved expense claim. The amounts are large, so perhaps the expenses were incurred by a senior manager or just possibly a journalist. Similarly, if you make a sale, the amount is credited to the sales account. It will eventually contribute to revenue in the profit and loss account. This resulted in postings to the Insurance Account and the Bank Account. Each account has a separate page in the ledger, though in practice the records are likely to be computerized.

- The equation remains in balance, as the equivalent increase and decrease affect one side—the asset side—of the accounting equation.

- For the accounts to remain in balance, a change in one account must be matched with a change in another account.

- Some thinkers have argued that double-entry accounting was a key calculative technology responsible for the birth of capitalism.

- Finally, we can say that the benefits of a double-entry system outweigh the drawbacks.

- There are no revenues because no delivery fees were earned by the company, and there were no expenses.

The double-entry system of bookkeeping standardizes the accounting process and improves the accuracy of prepared financial statements, allowing for improved detection of errors. All types of business accounts are recorded as either a debit or a credit. In this transaction, the asset account “Computer” is increased by $1,000, which represents the computer’s value. Just as assets are on the left side (or debit side) of the accounting equation, the asset accounts in the general ledger have their balances on the left side. To increase an asset account’s balance, you put more on the left side of the asset account. To decrease an asset account balance you credit the account, that is, you enter the amount on the right side.

The sheet is balanced because a company’s assets will always equal its liabilities plus equity. Assets include all of the items that a company owns, such as inventory, cash, machinery, buildings, and even intangible items such as patents. The trial balance labels all of the accounts that have a normal debit balance and those with a normal credit balance.

As you can see from the equation, assets always have to equal liabilities plus equity. For example, if an asset account is increased or debited, either a liability or equity account must be increased or credited for the same amount. It can take some time https://www.kelleysbookkeeping.com/ to wrap your head around debits, credits, and how each kind of business transaction affects each account and financial statement. To make things a bit easier, here’s a cheat sheet for how debits and credits work under the double-entry bookkeeping system.

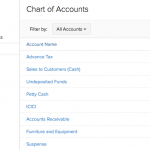

The trial balance is checked for errors and adjusted by posting additional necessary entries, and then the adjusted trial balance is used to generate the financial statements. A general ledger is the foundation of a system employed by accountants to store and organize financial data used to create the firm’s financial statements. Transactions are posted to individual sub-ledger what is a deferral its expenses prepaid or revenue not yet earned accounts, as defined by the company’s chart of accounts. Double-entry bookkeeping is usually done using accounting software. The software lets a business create custom accounts, like a “technology expense” account to record purchases of computers, printers, cell phones, etc. You can also connect your business bank account to make recording transactions easier.

When you generate a balance sheet in double-entry bookkeeping, your liabilities and equity (net worth or “capital”) must equal assets. The double entry accounting system is a method for companies of all sizes to accurately record the impact of transactions and keep close track of the movement of cash. The double-entry system creates a balance sheet made up of assets, liabilities, and equity.

If a company has $100 in assets and $110 in liabilities, then its equity would be -$10. If the accounts are imbalanced, then there is a problem in the spreadsheet. Double-entry accounting is a system where each transaction is recorded in at least two accounts.

发表回复