Your cart is currently empty!

Considered a renovation? Understand Your house Repair Financing Solutions

- Create Really worth

- Biggest Home improvements

Alesandra Dubin is an existence copywriter and you will content income blogger based into the La. The woman straight specialties become real estate; travel; health and wellness; meetings and incidents; and parenting. This lady really works has actually starred in Company Insider, An effective Cleaning, Today, E!, Moms and dads, and you may plenty of most other shops. She retains a beneficial master’s knowledge into the news media off NYU.

From the HomeLight, all of our sight was a world where the home deal are simple, particular, and rewarding. Therefore, we promote rigid editorial ethics in all of our posts.

When you look at the 2020, an average American household spent $8,305 on the home improvements – that is nearly the specific count an average family has within family savings, predicated on Bankrate’s previous investigation of data regarding the Federal Set-aside.

But rather than just draining the coupons, most home owners opt to loans their residence do-it-yourself that have borrowing or a home restoration loan. A recently available questionnaire by the Find House Collateral Finance reveals that 23% out of property owners want to buy their restoration that have a credit credit, 18% that have a property security credit line (HELOC), 13% with property equity financing, and you can eight% that have bucks-aside re-finance.

If you’re considering taking out property repair mortgage so you’re able to liven upwards a powder room or abdomen the kitchen, we you shielded. Our very own specialist-supported primer unpacks the new assortment of repair financing options available now and how it feeling your following household deals. We are going to and share easy methods to focus on restorations systems one incorporate worth to your house to help you recoup their capital.

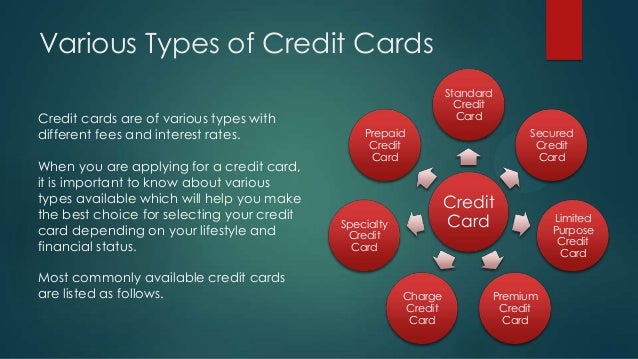

An introduction to household renovation mortgage options

While you are wanting taking out fully a property repair mortgage, you really have choices. The following is an introduction to the most common household restoration fund readily available:

Cash-aside re-finance

With this particular choice, the brand new borrower refinances its existing financial, plus the financial enhances an extra matter inside bucks towards recovery project. Typically, loan providers will allow home owners to re-finance 80% to help you 90% of one’s property’s really worth.

You can look at this alternative if you have at least 20% equity about assets and you can a strong credit score, and can be safer mortgage loan less than your current one. A primary upside having a funds-away refinance is the fact it’s a basic first-mortgage mortgage, maybe not a secondary lien otherwise personal line of credit.

Build financing

Property owners are able to use a homes mortgage to pay for residential property, building labor and you will information, enabling, or other related expenditures getting characteristics. Speaking of small-title financing (always on the annually) that have high rates. To qualify for a property loan, you’ll want to deliver the bank the in depth enterprise arrangements, background towards authorized builder controlling the opportunity, at the very least 20% collateral of your house, and you can proof of your capability to repay the mortgage (proof money and you may a good credit score record).

Owner-builder construction loan

If you plan to construct your home, a manager-builder mortgage is the loan to you. Lenders see these consumers since the higher risk (the systems may take longer and you can come upon significantly more dilemmas), very such money can be more difficult in order to qualify for. You will have to show reveal structure package having can cost you to help you reveal you’re competent to work.

If you’re such fund feature a high interest rate, you can recover the price should your finished investment contributes value to your residence; plus, you will probably make up for the greater attention together with your deals away from forgoing a contractor.

House guarantee loan and you will HELOC

Home collateral money enables property owners which have equity to view bucks of their homes having home improvements (or other requires). Typically, these types of money where you can utilize your own guarantee wanted a second lien (otherwise second mortgage) and additionally your current mortgage. Because these money is actually covered up against their equity at home, loan providers you’ll render all the way down costs than just they would having your own loan.

发表回复